Capital One Venture X Credit Card

Capital One Venture X Credit Card

November 12th, 2021

Due Diligence:

I’ll be the first to admit I knew nothing (nor did I care to) about Capital One prior to the launch of the Venture X card. I have heard though that they love some predatory lending, and based on the one date I went on with a guy who worked at Capital One when I lived in DC, I could see how they got the rap 🤪.

But times are different now. We hold men (and financial institutions) accountable for their behaviors (but not really). The truth is the value proposition of Capital One hasn’t appealed to me in the past, just like the guy who worked there. Venture X card changed the game. This is Capital One’s entrance into the premium card market. So is your toxic ex finally marriage material now? Let’s ask the girlfriends in the group chat.

Underlying Asset:

100,000 Capital One Miles.

Strike Price:

$10,000. Spend $10,000 within the first six months of account opening.

Expiry Date:

Ongoing.

T&C Highlights:

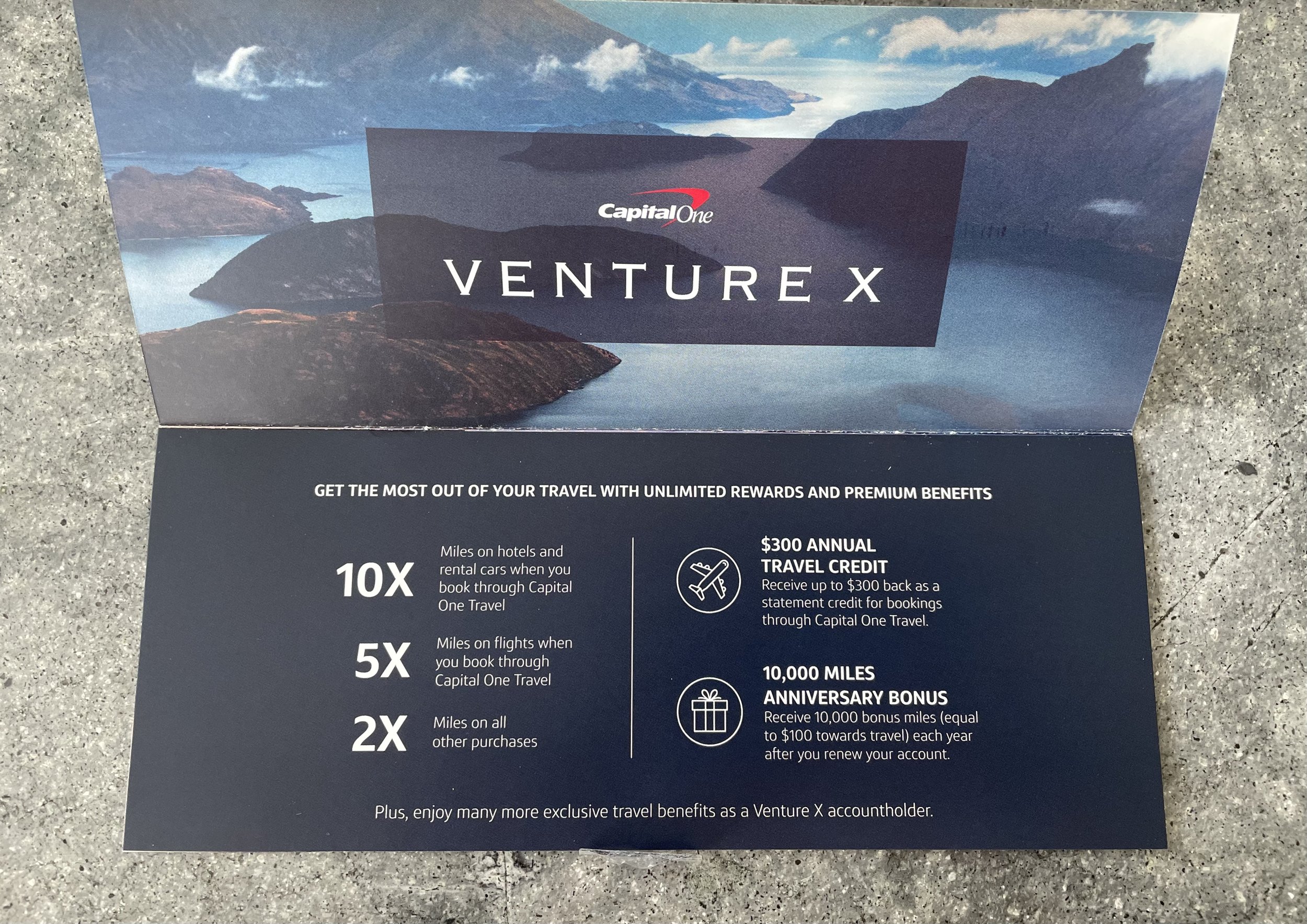

- $395 annual fee

- $300 annual travel credit for travels booked on Capital One Travel

- for a limited time, $200 vacation rental credit (Airbnb, VRBO, Turnkey & Vacasa)

- 10,000 bonus mile at every account anniversary

- 10x miles on hotels and rental cars on Capital One Travel

- 5x miles on flights on Capital One Travel

- 2x miles on all other purchases

- lounge access (Capital One lounges & Priority Pass)

- no foreign transaction fees

- no cost to add additional users

- Hertz President’s Circle status

- for a comprehensive list of card benefits and terms, please visit here.

Settlement:

As you can tell based on the list, Capital One is really going all in with the debut of this new card. Before the analysis, I wanted to share my experience with applying for Venture X.

I applied on the day it was launched, and the application process was a little bit more detailed than what I’m used to with other card issuers. One thing that stood out to me was the question asking whether I normally carry a balance on my credit card, and if so, how much? Interpret it how you want. While I have seen elsewhere on the internet that Capital One rejects people who don’t carry balances, that wasn’t the case for me. I chose “I normally do not carry balances” and was instantly approved. My credit score is in the upper 700 quartile with no existing relationship with Capital One. Note that Venture X is a Visa Infinite card, hence the minimum credit line is $10,000.

Two days later, my cards arrived in a Fedex envelope.

Capital One Venture X Card Welcome Package

Along with the cards were the welcome brochure and card agreement.

Capital One Venture X Card Welcome Package

Capital One Venture X Card Welcome Package

Capital One Venture X Card Welcome Package

Capital One Venture X Card Welcome Package

Up until this point I haven’t paid attention to the card design. Like most premium cards these days, they are metal cards with all the card information on the back.

Capital One Venture X Card Welcome Package

Capital One Venture X Card

Capital One Venture X Card

While I can’t say I love the look, I don’t hate it? The color choice is a departure from the traditional premium credit card colors such as silver, gold or black. The design is extremely simplistic, and I don’t think there’s much to dislike. Does it scream premium? No. But again, for $395 annual fee it’s really not priced as premium as the other cards on the market.

What really made me pull the trigger on this card is the value it offers. While other cards are valuable to different segments of the market, Venture X is the first card that is so versatile that I think anyone who can have this card should.

First of all, while the $395 annual fee isn’t insignificant, it is a lot cheaper than American Express Platinum card ($695), Chase Sapphire Reserve ($550) and Citi Prestige ($495). It’s free to add additional users to Venture X, while Amex charges $175 and Chase charges $75. Furthermore, you immediately get $300 back as a travel credit if you book on Capital One Travel. This is essentially a no-strings-attached cash-back. Generally I don't recommend booking hotel stays on OTAs since you don’t get hotel points for those bookings. Flight bookings on OTAs earn you the same miles regardless of where you book. $300 is pretty easy to spend in this economy if you ask me. Additionally, on each card anniversary you get 10,000 Venture miles. There is no requirement for these miles as long as you renew your card. At a minimum these miles could be used for $100 worth of travel expenditures. Combined with the $300 travel credit, your annual fee is completely offset, bringing the cost of carry to the negative territory. You even make $5 by simply having this card. A whopping 1.27% return on your principal, treasury bills who? Of course, there are other ways to spend these miles for outsized value, which I’ll save for another post.

Now that the annual fee becomes a wash, every other incremental perk you receive is just icing on the cake. Venture X card grants you access to Capital One lounges and Priority Pass lounges. While Capital One lounges are still limited in presence, Priority Pass membership provides you with a network of over 1,300 lounges worldwide and is arguably the most valuable lounge membership in existence. Unlike the Priority Pass membership offered by American Express, Venture X’s Priority Pass membership includes Priority Pass restaurants, where you get a per diem for each visit to spend on food and beverages.

Venture X lets you earn 10 miles/$ spent on hotel and car rental bookings, and 5 miles/$ spent on flights on Capital One Travel. There is an opportunity cost to booking hotels on Capital One Travel for reasons I mentioned previously. 5 miles/$ on flights is on par with the highest reward currently offered by Amex for this spending category.

However, the single most rewarding aspect of Venture X card is the ability to earn 2 miles/$ spent on every other purchases. Although 2 miles/$ is not groundbreaking on its own, it is the first time we see a travel credit card bonuses non-travel related purchases. For someone with too many credit cards, Venture X helps downsizing your wallet as you can instantly retire those cards earning 1.5X or 2X on everyday purchases.

Last but not least, a sign-up bonus of 100,000 miles is definitely one of the highest I recall. My partner always asks me “well what do you get for 100,000 miles?”, and I feel like that’s the question most of y’all would have as well. The inherent value of these miles is $1,000, as you can redeem 1 mile for each cent spent on Capital One Travel. The arbitrage here is to transfer these miles to airline programs, where you can redeem them for the first or business class flights of your dreams. Capital One has really improved its mile transfer program and now includes a wide swathe of partners at rates comparable with other bank points programs.

A few good examples come to mind immediately. We go to the Caribbeans rather frequently but flights from the US to these warm beaches can cost you between $500 to $800 per person in economy in high seasons. You can transfer your Venture miles to British Airways Avios at 1:1 ratio and redeem 15,000 miles for a round-trip economy ticket between Miami and Providenciales. Illustratively a couple can go to Turks and Caicos 3 times with 10,000 miles left. The cash price is consistently around $500-$600 if traveling around a US long weekend so conservatively you are looking at $500 x 3 x 2 = $3,000 in value.

Or if your aspiration is in premium travel, you can transfer 99,000 miles to Singapore Airlines KrisFlyer for a one-way business class ticket flying the world’s longest flight from New York to Singapore and then to anywhere else in South East Asia. You can even have a stopover in Singapore at no extra cost. You can also transfer 57,500 miles to Air Canada Aeroplan for a one-way business class ticket from US to Europe on a host of carriers such as Swiss, Lufthansa, United and more. These tickets can easily run you anywhere from $3,000 to $5,000 and beyond so the opportunities are endless.

I’ve had the new Capital One Venture X card for a bit over 2 months now and am absolutely loving it. $10,000 minimum spending is a bit on the higher side, but it has been easy for me with all the holiday shopping and travels. I have already been reimbursed the $300 travel credit for booking domestic flights for our Thailand trip on Capital One Travel, which you can check out here. Capital One Venture X didn’t completely change how I use my cards. I’m still using my American Express Gold card for restaurants and groceries, Chase Freedom for its quarterly 5% categories and American Express Platinum card for Fine Hotels & Resorts bookings, but I’ve found myself putting virtually everything else on Venture X, from online and in-store retailers to paying off various bills.

Capital One Venture X card is a well-rounded product that we don’t see often. It has reasonable annual fee compared to other substitute cards within the same range, offers great benefits if you travel at any frequency and is a card that you’ll find yourself always carrying with and putting spendings on. As I say to my partner whenever I wanted something, “it’ll be stupid not to take advantage of a deal like this”. So click on this shameless plug and apply now to earn your own bonus miles. Your '“TAKE ME BACK TO IBIZA” post will thank you later.